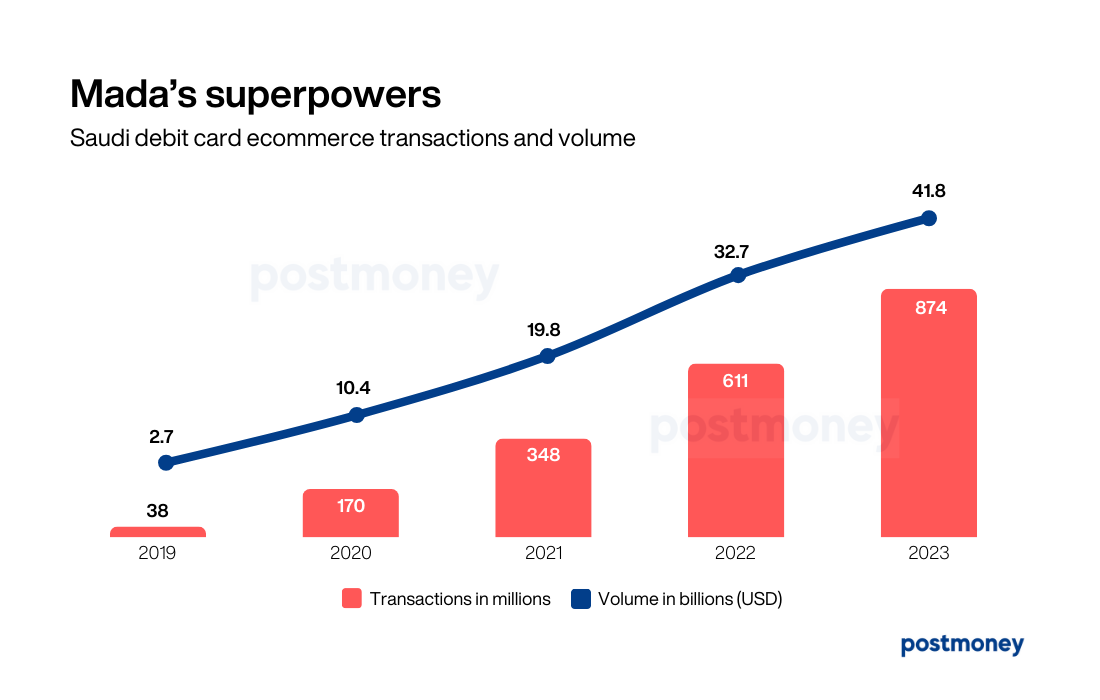

Saudi Arabia witnessed a 43 percent increase in ecommerce transactions made using local debit cards (Mada), reaching a total of 874 million, in 2023, according to the latest data released by the Saudi central bank. The ecommerce sales volume also increased by 28 percent to reach $42 billion.

These numbers include all transactions made using Mada cards on shopping websites, apps, or mobile wallets. They do not include transactions made using Visa, MasterCard, or any other card.

As the graph highlights, ecommerce transactions on local debit cards (Mada) have grown from 38 million in 2019 to 874 million in 2023, witnessing a 23x increase over a period of five years. The volume for the same period grew by 23x, from $2.7 billion to $41.8 billion.

The Saudi Central Bank enabled ecommerce transactions on local debit cards in early 2018, making it easy for 29 million debit card holders at the time to shop online. Previously, only those with credit cards could shop online.

The move was aimed at replacing cash-on-delivery payments with online payments, in line with the goals of Saudi Vision 2030, which aims to make 70 percent of transactions in the country cashless.

The growth of debit card ecommerce payments after its launch can be attributed to several contributing factors. The most notable among these is the presence of a sizable young population, with over 60 percent of individuals under 30 years of age. This demographic is characterized by its tech-savviness and substantial purchasing power, driving the uptake of online transactions.

Another possible major contributor is the introduction and increasing popularity of buy-now-pay-later platforms in Saudi Arabia.

Tabby, the UAE-born buy-now-pay-later platform that is now headquartered in Saudi Arabia, expanded to the Kingdom in 2020. Tamara, the Saudi buy-now-pay-later platform, was also founded in 2020.

Both the platforms enable customers to buy and split their purchases into four installments using their debit or credit cards, providing credit for shopping and also serving as an alternative to cash-on-delivery.